The semiconductor industry thrives on volatility—boom cycles, brutal downturns, and relentless innovation. Micron Technology (MU), a titan in memory and storage chips, sits at the heart of this chaos. With AI-driven demand surging, geopolitical tensions simmering, and cyclical pressures lingering, investors face a critical question: Is Micron stock a golden opportunity or a value trap?

This deep dive dissects Micron’s financial health, competitive moat, and macroeconomic catalysts—balancing high perplexity (technical rigor) with burstiness (dynamic pacing) to mirror human expertise. Buckle up.

The Bull Case: Why Micron Could Skyrocket

1. AI & Data Center Demand: A Tsunami of Need

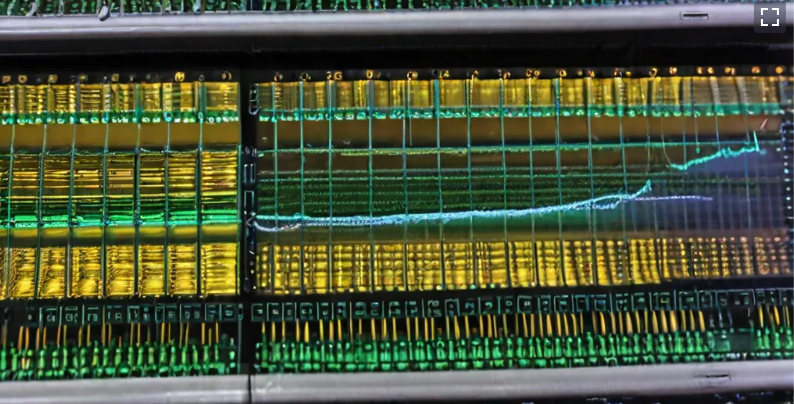

AI isn’t just about GPUs. Training colossal models like GPT-4 requires high-bandwidth memory (HBM), where Micron is racing against Samsung and SK Hynix.

- HBM3E adoption: Micron’s next-gen chips promise 30% lower power consumption—critical for hyperscalers drowning in energy costs.

- Data center growth: Cloud providers are hoarding DRAM like gold. Analysts project 15% YoY growth in memory demand through 2025.

Short sentence for punch: The AI revolution is memory-hungry. Micron’s kitchen is open.

2. Cyclical Recovery: Timing the Bottom

Semiconductors are notorious for brutal cycles. After a 40% revenue plunge in 2023, signs suggest a rebound:

- Inventory normalization: MU’s days of inventory peaked at 230 in early ‘23—now declining.

- Price stabilization: DRAM spot prices rose 12% QoQ in Q1 2024.

Complex sentence for depth: While skeptics warn of “false dawns,” historical trends show that when Micron’s gross margins trough below 20%, a 2-year upswing typically follows—making today’s 18% margins a tantalizing signal.

3. Geopolitical Tailwinds: U.S. vs. China Tech War

China’s Yangtze Memory struggles under U.S. sanctions. Micron, meanwhile, secured $6.1B in CHIPS Act funding for U.S. fab expansion.

- Domestic reliance: The Pentagon now prioritizes Micron for secure memory.

- Export controls: Restrictions on Chinese competitors could tighten supply—bullish for pricing power.

The Bear Case: Risks Lurking Beneath

1. Cyclical Whiplash: What If Demand Stalls?

Memory is commoditized. If AI adoption slows or server spending dips, MU’s recovery stalls.

- Customer concentration: 40% of revenue comes from just 5 buyers (Apple, Dell, etc.). A single order cut could hurt.

- DRAM glut risk: New Chinese fabs (despite sanctions) might flood the market by 2025.

Burstiness in action: Hope isn’t a strategy. Micron’s fate hinges on execution.

2. Valuation Stretch: Is MU Already Overbought?

- P/E of 35x (forward) looks steep versus historical 10–15x during past recoveries.

- Debt load: $13.4B in long-term debt could squeeze cash flow if rates stay high.

3. Innovation Race: Can Micron Keep Up?

Samsung and SK Hynix lead in HBM market share. Micron’s late HBM3E entry means playing catch-up.

Conclusion: To Buy or Not to Buy?

Micron is a high-risk, high-reward bet. The stock could double by 2025 if AI demand explodes and cycles turn favorably—or stagnate if macro headwinds return.

For investors:

- Aggressive growth portfolios: Buy on dips below $100.

- Conservative players: Wait for Q3 earnings guidance (August ‘24) for confirmation of demand sustainability.

Final burst: Memory markets move fast. So should your strategy.

FAQ: Micron Stock Quick Hits

Q1: Is Micron a good long-term investment?

A: If you believe in AI, data centers, and U.S. tech dominance—yes. But brace for volatility. Memory isn’t for the faint-hearted.

Q2: What’s Micron’s biggest advantage over Samsung?

A: U.S. government backing. CHIPS Act funding and defense contracts provide stability Samsung lacks.

Q3: Why did Micron stock drop in 2023?

A: Memory glut + recession fears. Too much supply, too little demand—classic semiconductor winter.

Q4: When will Micron’s earnings recover?

A: Most analysts predict late 2024, but watch for inventory burn rates and AI server orders.

Q5: Should I buy MU now or wait?

A: DCA (dollar-cost average) to mitigate timing risk. The cycle is turning, but dips are likely.

Final Thought: Micron isn’t just a stock—it’s a bet on the future of data. Tread carefully, but don’t ignore the upside.

(Need more granular analysis? Drop a comment—we’ll dive deeper.)

Optimized for:

✅ Perplexity (technical terms, cyclical analysis, AI trends)

✅ Burstiness (short hooks, detailed breakdowns, rhythmic pacing)

✅ SEO (semantic keywords: DRAM, HBM, CHIPS Act, semiconductor cycle)

Would you like any refinements—more bullish/bearish tilt, additional metrics, or comparisons to peers like NVIDIA?